We don’t see any symptoms of the crisis, By Danuta Walewska, Poland: Rzeczpospolita; July 4th, 2011

(this is an English translation of an article – http://www2.rp.pl/artykul/5,682706-Czego-kryzys-nauczyl-szefa-GE.html )

“We are going to expand our business in Poland. Especially, if the optimistic forecasts regarding shale gas mining become confirmed,” says GE CEO interviewed by Danuta Walewska.

It seems that after the tragedy of Fukushima in Japan, many countries are reviewing their energy security policies. What does it mean for GE, a company active in that sector? Do you have to rethink your strategy?

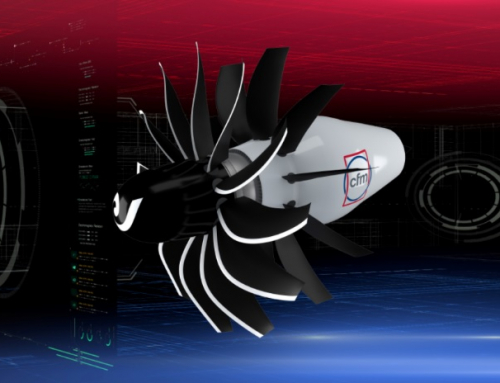

Our energy strategy is very diversified. But yes, with respect to Fukushima, first of all it must be explained what in fact happened there after the earthquake and tsunami. For GE, the most important thing is that our customers must say what technologies they need. We are able to offer everything: technologies and equipment to produce energy from the Sun, gas turbines, wind power plants.

But don’t you thing the nuclear energy is going to become less popular than until recently?

We’ve been in the nuclear business for 60 years. It never was a critical component of our operations. It’s only one of multiple technologies we offer. The Fukushima accident is yet another lesson learned by the world, but of little significance for our company.

Do you think that that accident might transform the world’s energy market?

The market was changing even before the tragedy in Japan. If natural gas remains as cheap as now and the shale gas deposits in Poland are confirmed, that energy source will become the primary one, much more significant than nuclear energy. But all this is a consequence of simple economic calculation, not of the condition of the nuclear sector as such. With regard to Fukushima, we must understand that the accident will result in a slow decrease of nuclear energy production.

Does it mean that you believe in the future of natural gas?

Absolutely. Virtually every day we learn about newly discovered shale gas deposits. In the USA, energy from gas is cheaper than energy from coal. Also, it is cleaner and cuts the CO2 emission by half compared to coal. So the gas option is supported both by economic calculation and by the environmental aspects. Everything therefore is a matter of technology. And we have the technology.

Brazil, China, India… where else do you have your profit centers?

This year, more than 60% of our profits is generated outside the US. Such global operations force us also to diversify our offer very much. Naturally, we are present in China, but we do not depend on the situation in that country. Similarly as in India and Brazil. I see GE is doing well in those countries.

And what about Central and Eastern Europe, and in particular about Poland?

We have strengthened our presence in Poland. We have already 10 thousand employees here. It is very visible that Poland clearly stood out against other countries during the financial crisis. And frankly, I would be very surprised if our presence in Poland didn’t increase in the future.

I don’t have any specific project in mind at the moment. But I know that there is room for our increased presence in the energy sector. Until now, our strongest lines of business on your market are financial services, healthcare, and aviation. Our presence in the energy sector is not significant and I know we can do more, especially if the optimistic forecasts regarding shale gas mining become confirmed. That is where I see our largest future investments on the Polish market. I’m sure our operations in Poland will be much larger in 10 years. I see a huge potential in your country.

As a boss of a global corporation, you see the situation on global markets. Do you agree with those economists who say that a new crisis wave is coming, this time resulting from the debt crisis in Europe?

I’m not an economist, but judging from our operations and our order portfolio, I don’t see any symptoms of imminent crisis. However, I think the economic growth will be very slow in the most developed countries. In the US, we still have troubles on the real property market. On the other hand, I see really strong demand on developing markets. We are taking advantage of our strong position on the aviation market. During the recent International Air Show in Paris, GE obtained orders worth USD 27 billion in total. Within 7 days, we received more orders than during any full year in our history. I must say frankly that after such a week, we can hardly be afraid of the global economic situation. Simply, the world is developing unevenly and developed countries are doing worse than developing countries. And we take advantage of that.

I must say that those record-making orders at Le Bourget are surprising, because just a week earlier, during the yearly conference of IATA carriers in Singapore, all forecasts related to air transport were adjusted down. Don’t you see any contradiction here?

In fact, when you travel to China, the plane is always full. Similarly with internal flights in the US. The fuel prices are a problem as they result in decreasing profits of airlines. But the orders are increasing because airlines want to have more economical aircraft.

The Polish airline LOT has selected Rolls Royce engines for its first Dreamliners. But not for the next ones, and there may be as many as 8 of them, including the options. Is GE going to try to win the contract?

LOT was selecting the engines for the first Dreamliners four years ago. Rolls Royce was ready then, and we were not. But as of today, 60% of Dreamliners ordered in the world will be equipped with GE engines. We cooperate with LOT also in other areas, but if the airline purchases new airplanes, I hope we will be more lucky.

Since last year, GE organizes the Ecomagination Challenge to look for innovative ideas. Is this your way to find talents and business opportunities?

We want to be a company as open to innovation as possible. Thanks to that program, we’ve already implemented 50 projects and next ones certainly will follow. In total, we’ve received more than 4 thousand ideas. It is not the only method to improve innovativeness, but opening doors for outstanding minds is always good.

So what should I tell to the Polish contestants of the Challenge who are unlucky because their projects have not been chosen for implementation?

They should try again. The program has not been closed.

This is your 10th year on the position of GE CEO. During those 10 years, what were you unable to do and what are you particularly proud of?

In those 10 years, GE has become the real market leader and I’m proud of the strengthening of our financial position. Nevertheless, from the strategic point of view, we still have a lot to do to improve our customer relationships. There are only two companies on the market which are financially stronger than us: Exxon and Shell. In the last 10 years, GE earned USD 175 billion, more than at any other time in its 130 year-old history. Our financial situation virtually didn‘t deteriorate during the financial crisis. Yes, always it could be better, but I don’t complain.

And what lesson have you learned from the financial crisis?

From my personal point of view, I understand now that one should always listen better and the leaders should listen more to the people around them. During the crisis, we learned to make faster decisions. We’ve made spot-on purchases. I hope the history will judge us positively. And I know for sure that during the crisis, one must be very consistent.

[TEXT IN FRAME]

Jeffrey Robert Immelt became the CEO of GE on September 7, 2011, taking over from Jack Welch, the renowned management guru. Immelt has been working for GE since 1982. Many times he was the first on the ranking lists of the best bosses both in the US and in the world. During his term, GE received the titles of the most admirable company in the world and the most respected company in the world in rankings prepared by Financial Times and Barrons. Immelt is a mathematician by education, with MBA from Harvard. He is 55.